By Jan White

This email address is being protected from spambots. You need JavaScript enabled to view it.

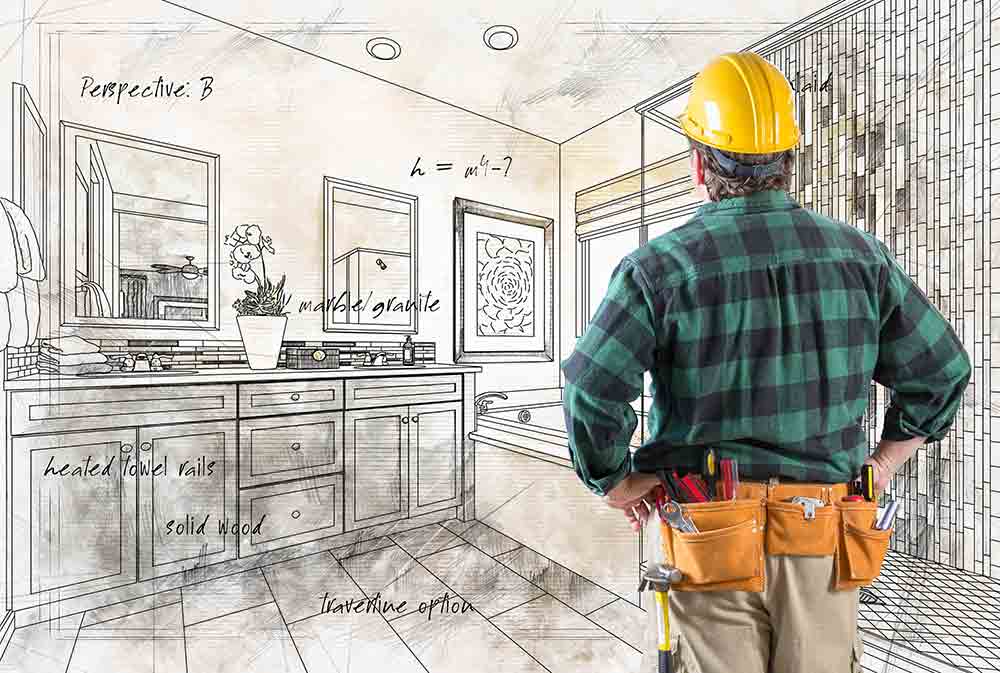

Maybe you’ve been thinking lately about renovating or improving your home. Renovations can be a great way to infuse your personality and style in your home and address space or safety issues.

No matter what has to be done, home improvements can be costly. According to the financial resource SoFi, renovating or remodeling a whole house costs, on average, between $10 and $60 per square foot. Certain rooms, such as kitchen or bathroom remodels, demand an even higher price, costing up-wards of $100 to $250 per square foot due to electrical and plumbing needs. Determining how to pay for the improvement project is as vital to the planning process as picking out materials and contractors.

Here are some financial considerations and financing options for homeowners looking to renovate their properties when costs exceed available cash.

• Is the investment worth it? According to “Remodeling” magazine, in 2022, a homeowner spending $4,000 on a garage door replacement recouped 93.3 percent of the investment, whereas adding a midrange bathroom at $63,000 would only offer a 51.8 percent return. Homeowners must decide whether it will pay to move forward with the project if they’re like-ly to get a lower return on their investment should they choose to sell the home later.

• Refinance your home mortgage. Homeowners can tap into a home’s equity by using a cash-out mortgage refinance to access thousands of dollars for a remodel. Just keep in mind that the new mortgage will be at the current interest rate and have an outstanding balance higher than the original. Typically, twenty percent equity in the home is needed to refinance.

• Take out a personal loan. For those who do not want to refinance, a personal loan or home improvement loan can be suitable for midsized projects, according to American Express. Personal loans for home renovations typically require no collateral, and one’s credit score determines the interest rate.

• Utilize a home equity line of credit or loan. A HELOC is a form of revolving credit, like a credit card. Homeowners borrow against the credit line granted, with the home being the col-lateral. As a person pays down what is owed, they can borrow more.

You could also try a home equity loan. Home eq-uity loans use the home as collateral like a HELOC. The home equity loan is an installment loan for a fixed amount on a fixed monthly schedule for a set term. These are sometimes called second mortgages.

• Use a no or low-interest credit card. Smaller projects can be financed using credit cards. Many will offer introductory rates with no interest for a few months.

You are a guest

or post as a guest

Be the first to comment.